The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC]

![The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240302/16/original_98c8f5fb-79e9-4ef6-b571-95624bc5686a.png)

Some Highlights

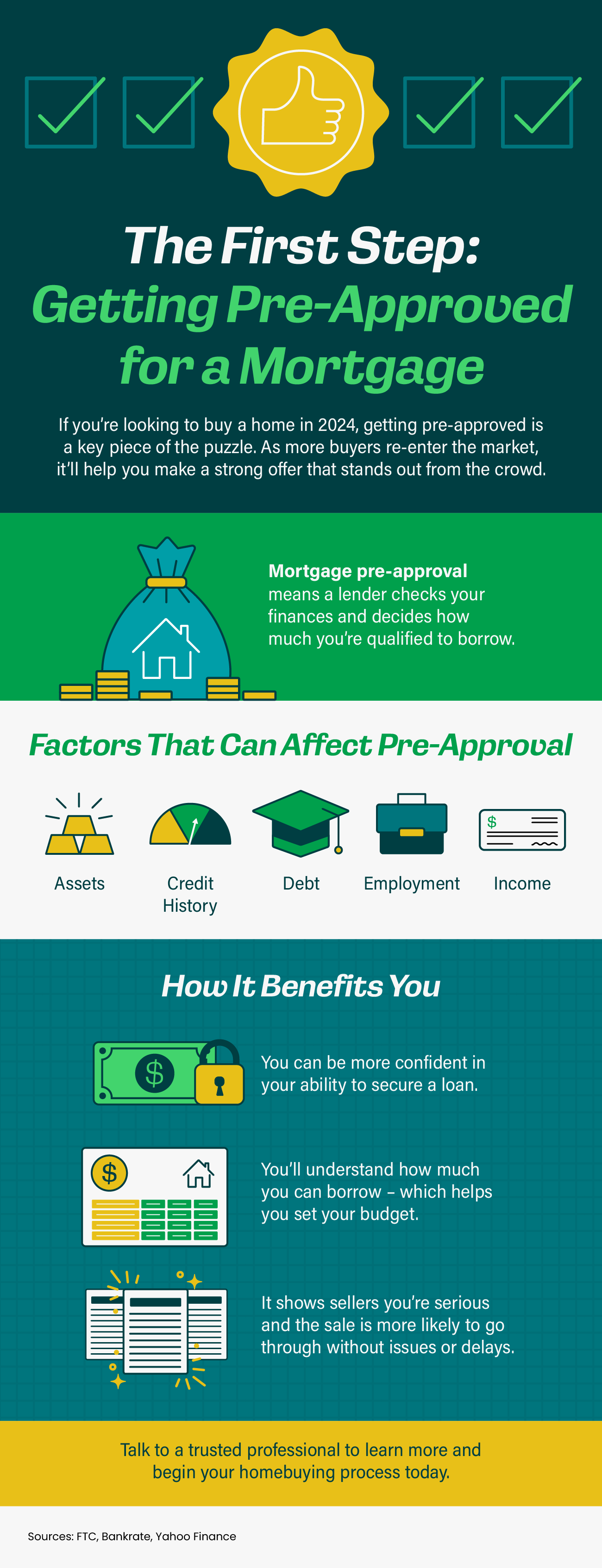

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

Recent Posts

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

Your House Didn’t Sell. What Now?

Headlines Have You Worried about Your Home’s Value? Read This.

Is January the Best Time To Buy a Home?

Is Buyer Demand Picking Back Up? What Sellers Should Know.

How To Stretch Your Options, Not Your Budget

Your Equity Could Change Everything About Your Next Move

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "